Nine Tenth: A Biblical Guide to Financial Discipline & Freedomഉദാഹരണം

Day 6: Leaving a Legacy—Wealth, Retirement, and Estate Planning

This is one of our favorite topics because building wealth, living an impactful life, and leaving a lasting legacy is what financial freedom is all about! True financial wisdom ensures that your wealth benefits future generations and furthers God’s kingdom. Financial freedom isn’t just about comfort; it’s about stewardship—using our resources to bless others while securing our family’s future.

Wealth Accumulation and Retirement Planning

Wealth gained hastily will dwindle, but whoever gathers little by little will increase it.

—Proverbs 13:11 (ESV)

Many of us have dreamed about retiring on a beach while watching sunsets. Sadly, many of us feel that financial security in retirement is out of reach. We have great news: You can retire comfortably and still enjoy the fruits of your labor with proper financial planning.

Building Blocks to a Secure Retirement

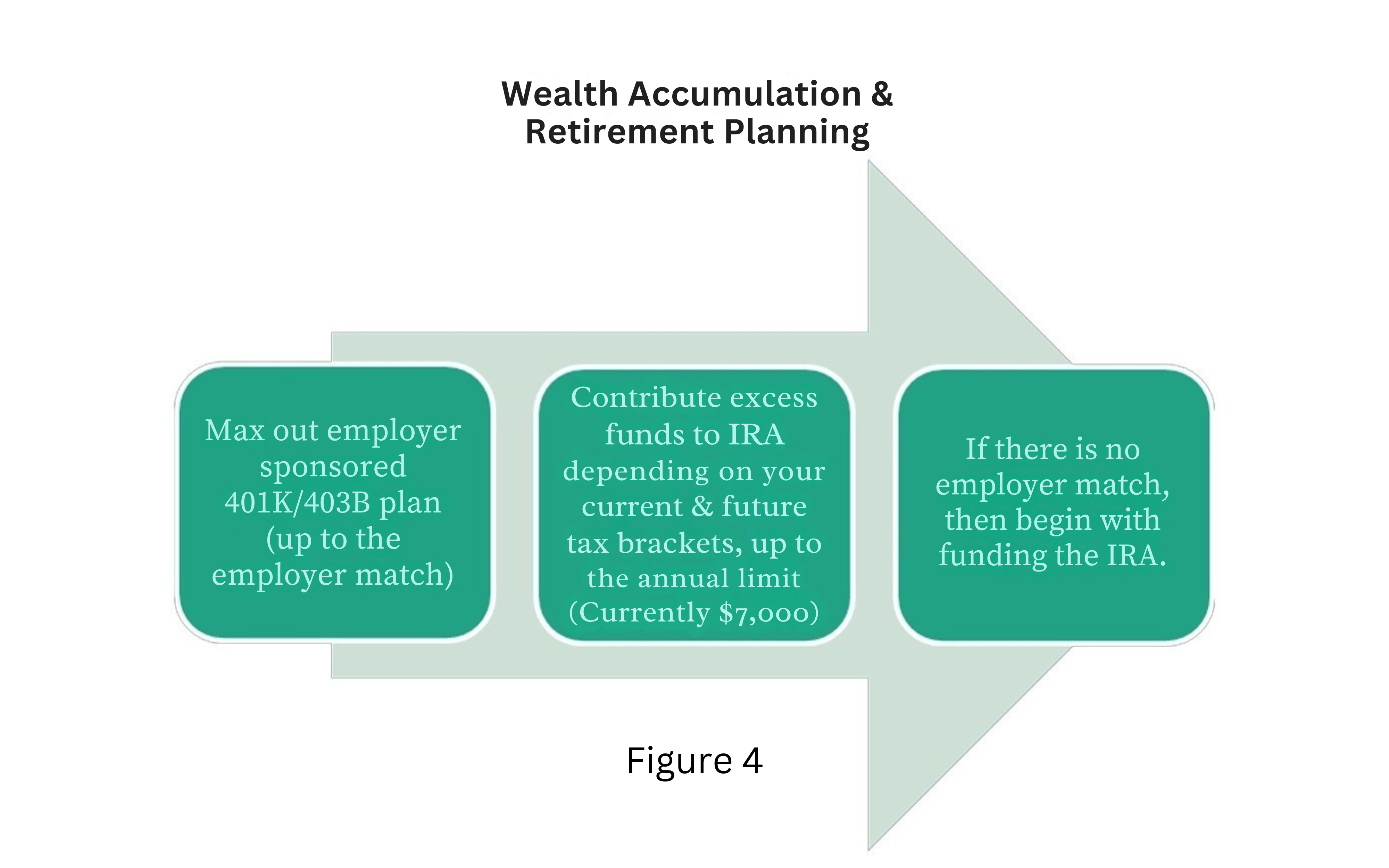

A strong retirement plan includes multiple retirement vehicles and requires diversification. Putting all your money into one type of investment—like a single stock or real estate—can be risky. Diversifying across stocks, bonds, and mutual funds within these three vehicles alongside your real estate investments spreads the risk and helps protect your wealth over time. Here are three key investment vehicles:

- 401(k) or 403(b) Plans

- Employees make pre-tax contributions.

- Many employers offer matching contributions (That's free money!).

- Funds grow tax-deferred until withdrawal at retirement.

- Traditional Individual Retirement Account (IRA)

- Contributions are tax-deductible.

- Withdrawals are taxed at the normal income tax rate.

- Can begin penalty-free withdrawals at age 59.5.

- Roth IRA

- Contributions are made with after-tax dollars.

- Earnings and withdrawals are tax-free in retirement.

- Best if you expect to be in a higher tax bracket later.

- Can begin penalty-free withdrawals at age 59.5.

Start Early and Leverage Compound Interest

The earlier you invest, the more your money grows. That's the power of compound interest. Similar to the debt snowball we learned about on Day 5, small, consistent investments can snowball over time. Proverbs 13:11 reminds us that wealth grows "little by little" when managed wisely.

Estate Planning: Securing Your Family’s Future

Good people leave an inheritance to their grandchildren...

-Proverbs 13:22 (NLT)

Making money and enjoying life is great, but what kind of legacy are you leaving behind? Here’s a little secret: Everyone (that means you) has an estate. Your estate includes everything you own: your home, car, life insurance, investments, and personal possessions. Without a plan, the courts may decide how your assets are distributed. We don't want that, remember?

Will versus Trust: What’s the Difference?

How do we stop the courts from deciding what to do with our estate? (Hint: We talked about it on Day 2, and the answer is just above.) You got it: a will! But there's another key term you need to know concerning estate planning–trust. Let's discuss the difference:

- Will: A legal document that outlines how your assets should be distributed after your passing. Without one, state laws decide who gets what.

- Trust: A legal entity that holds your assets, bypassing probate (the legal process of distributing a person's assets after they pass away) and allowing for structured distribution, tax benefits, and greater control over your legacy.

Proper estate planning ensures that your wealth is passed down efficiently and with minimal legal fees, taxes, and court costs. As we alluded to on Day 2, planning now prevents family disputes and financial struggles later.

Lifelong Generosity: Impacting Others Beyond Your Lifetime

Part of estate planning is determining how you want to be remembered. Many believers envision a world where they continue caring for the poor, widowed, and fatherless (James 1:27). How can you accomplish this even after you leave this Earth?

- Establish a Trust for Ongoing Giving

- Set up a charitable trust or endowment (a fund that is managed to support a specific purpose over time) that gives to organizations aligned with your values.

- This ensures a portion of your wealth continues blessing others for generations.

- Create a Foundation to Fulfill Your Philanthropic Vision

- Example: Our family founded the Ogunyemi Family Foundation, Inc., to provide resources, opportunities, and support to underserved communities.

- We structured our wills so that our foundation continues our lifelong commitment to generosity.

Family Moment: Legacy Beyond Money–Teaching Financial Wisdom

We've talked a lot about making a lifelong commitment to generosity through financial means, but our true legacy isn’t just leaving money—it’s leaving wisdom. Teaching your children about budgeting, investing, and generosity ensures that wealth continues to be a blessing, not a burden. Proverbs 22:6 reminds us, “Train up a child in the way he should go, and when he is old he will not depart from it.”

Use the budgeting tools from Day 4 to talk to your children about saving and investing for the future. It's never too early to ask:

- What do you want to be when you grow up? Show them the costs associated with that career path and how compound interest can help them achieve that goal if they start early.

- How would you make the world a better place if you had a bunch of money? This helps you understand their values and priorities.

- What steps will you take today to start building your legacy? This is an action question to help them understand that they can start now to achieve their future goals.

Consider giving your child a small “investment” (like $5 in a piggy bank) and track its growth as you both add spare change over time. Compare it to an example of compound interest in a savings account or investment fund. If your child is old enough to understand investing, show them how to invest in a mutual fund or index fund and track the growth over time. Seeing the difference will help reinforce the power of long-term savings and investing!

Final Thought

Your financial legacy starts today. Be intentional about wealth-building, retirement, and estate planning so your family can thrive for generations to come. Stewardship is about more than just money; it’s about faith, responsibility, and impact.

ഈ പദ്ധതിയെക്കുറിച്ച്

Struggling to manage money? Tired of living paycheck to paycheck? This 7-day Bible Plan, inspired by "Nine Tenth: Church Folks' Guide to Financial Discipline and Living Beyond Tithes & Offering" by Dr. Clement Ogunyemi, will transform how you see, use, and steward your finances. Brothers Dr. Clement Ogunyemi ("The Finance Doctor") and Olaolu Ogunyemi share biblical principles and practical steps to escape debt, build wealth, and leave a legacy. Learn how to budget wisely, invest with purpose, and honor God with your finances—all while securing a future for generations to come. Financial freedom starts now!

More

ബന്ധപ്പെട്ട പദ്ധതികൾ

നമ്മുടെ ദൈവിക വിധി അവകാശപ്പെടുന്നു

ദൈവത്തിൻ്റെ ഉദ്ദേശ്യപ്രകാരം ജീവിക്കുകയും അവൻ്റെ കൃപയെ സ്വീകരിക്കുകയും ചെയ്യുക

ഈസ്റ്റർ ക്രൂശാണ് - 8 ദിന വീഡിയോ പ്ലാൻ

പരിശുദ്ധാത്മാവിലുള്ള ആത്മീയ അവബോധം

വൈകാരിക പോരാട്ടങ്ങളെയും ആത്മീയ പോരാട്ടങ്ങളെയും മറികടക്കുക

എന്നോട് കല്പിയ്ക്കുക - സീറോ കോൺഫറൻസ്

വർഷാവസാനം പുനഃക്രമീകരിക്കുന്നു - പ്രാർത്ഥനയും ഉപവാസവും

വെല്ലുവിളി നിറഞ്ഞ ലോകത്ത് ഹൃദയത്തെ സംരക്ഷിക്കുന്നു

ബൈബിൾ മനഃപാഠ വാക്യങ്ങൾ (പുതിയ നിയമം)